The U.S. fashion retail industry, valued at approximately $564.2 billion in 2023, continues to evolve with a projected CAGR of over 3% through 2028. Understanding where retail outlets are located is essential to remain competitive in this dynamic sector. Scraping Fashion Retail Store Locations in the USA allows businesses to collect and analyze detailed data on store distribution, offering valuable insights into market coverage, customer accessibility, and competitive presence. Through Fashion Retailers Store Location Data Scraping US, companies gain strategic advantages by identifying underserved regions and evaluating the geographical footprint of leading brands. Moreover, stakeholders can Extract Clothing Store Chains Data in the US to monitor expansion trends, evaluate saturation points, and refine marketing efforts. This report delves into the methods and benefits of using web scraping to gather store location data, highlighting key players, areas with limited store presence, top cities for fashion retail, and providing a comprehensive table of relevant findings

The U.S. apparel market is a cornerstone of the global fashion industry, driven by high consumer spending and a diverse range of retailers. In 2022, the market generated approximately $312 billion in revenue, with specialist store-based retailing valued at over $300 billion and e-commerce contributing $183 million. The rise of e-commerce, projected to reach $145 billion in 2024 and $219 billion by 2029, reflects shifting consumer preferences toward online shopping, particularly among Gen Z and millennials. However, brick-and-mortar stores remain vital, offering tangible customer experiences and fostering brand loyalty. Fashion Retail Data Scraping enables brands to track these shifts and optimize location-based strategies. Key players dominate the market through extensive store networks and strong brand presence.

Other notable players include Kohl’s, Nordstrom, Gap, and fast-fashion brands like Zara and H&M, which balance physical and online presence to capture diverse consumer segments.

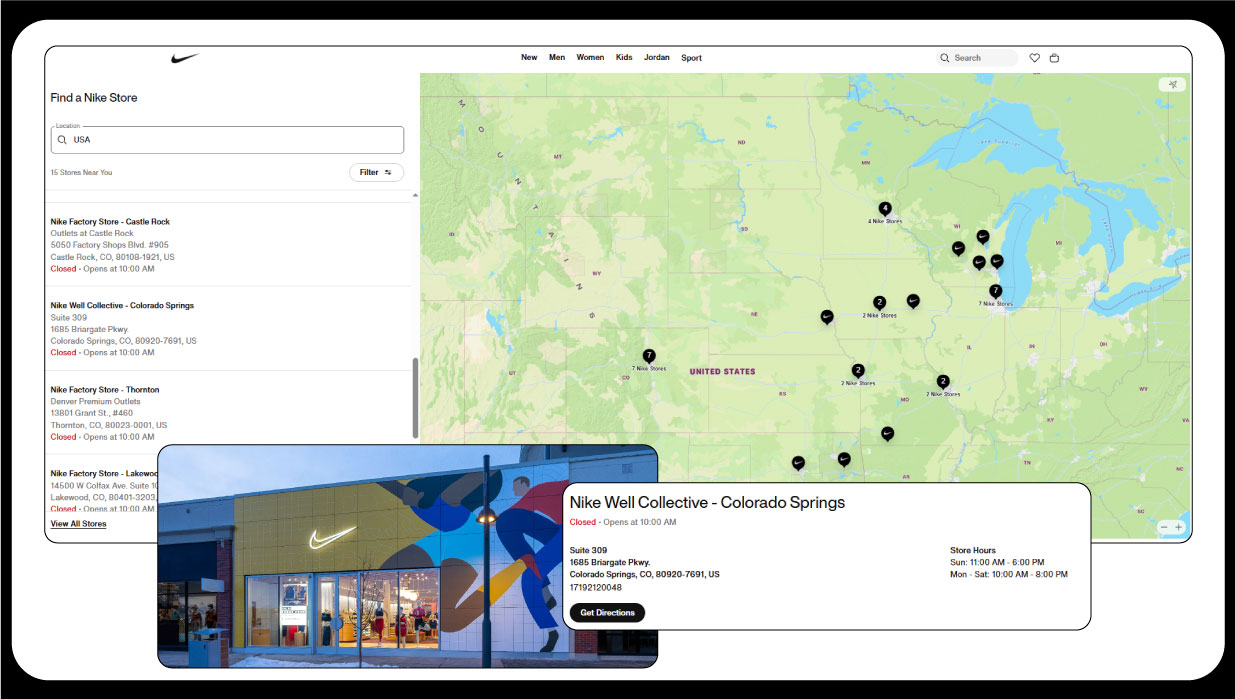

Web scraping is a powerful technique for extracting detailed store location data from various digital sources, including official retailer websites, dedicated store locator pages, and third-party platforms such as Google Maps, Yelp, and Yellow Pages. This process enables businesses to compile extensive datasets that support location intelligence and retail expansion strategies. A typical E-commerce Website Scraper employs Python-based libraries such as BeautifulSoup for parsing HTML content, Scrapy for structured crawling, and Selenium for interacting with dynamic web pages.

During the eCommerce Data Scraping process, critical information is gathered, including store names, physical addresses, cities, states, ZIP codes, and classification of store types—whether they are flagship locations, outlets, or temporary pop-up shops. This information is crucial for market segmentation and competitive analysis.

It is essential to follow legal and ethical guidelines while conducting Data Scraping from an E-Commerce Website, including compliance with website terms of service, honoring robots.txt protocols, and avoiding disruptive scraping behaviors. Once collected, the raw data undergoes cleaning and normalization and is then stored in structured databases. The resulting datasets can be integrated into geospatial analysis platforms or visualized using tools like Tableau, Power BI, or GIS software. This allows businesses to uncover location-based trends, assess market saturation, and strategically plan future retail development.

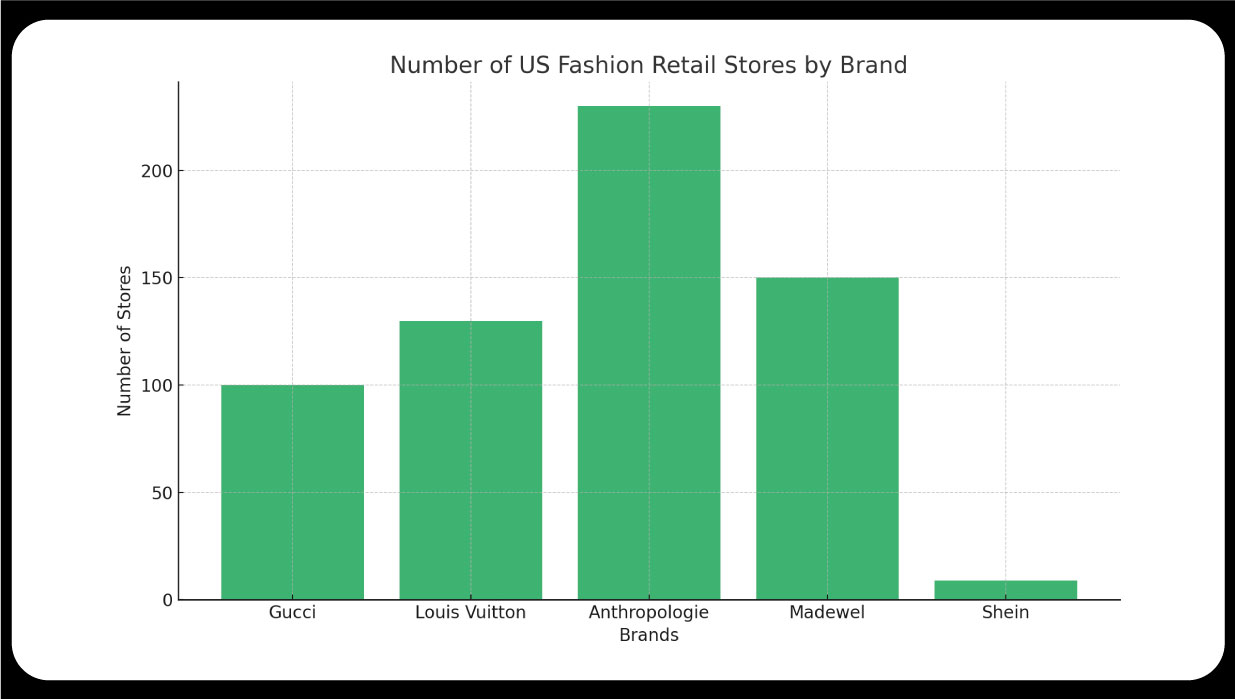

While major retailers dominate with thousands of stores, some prominent fashion brands maintain a minimal physical presence, focusing on exclusivity, e-commerce, or niche markets. Based on available data and industry trends, retailers with the least locations include:

These retailers leverage limited physical footprints to maintain brand exclusivity or rely heavily on online sales, reducing operational costs while targeting specific demographics.

The geographical distribution of fashion retail stores reflects population density, economic activity, and consumer spending patterns. Data from 2025 highlights the following trends among top retailers:

The South accounts for 34% of U.S. apparel retail locations, followed by the Midwest (25%), Northeast (22%), and West (20%). This distribution aligns with consumer demand for affordable and fast-fashion options in suburban and urban areas, while luxury retailers cluster in metropolitan regions.

Urban centers with high population density and tourism drive the concentration of fashion retail stores. The following table summarizes the top cities based on 2025 data:

| City | State | Number of Stores | Key Retailers |

|---|---|---|---|

| New York City | NY | 122 | Macy’s, Nordstrom, Gucci |

| Houstan | TX | 109 | Ross Stores, Kohl’s, Macy’s |

| Las Vegas | NV | 106 | Nike, Adidas, Gap |

| Orlando | FL | 88 | Gap, Banana Republic, Ross Stores |

| San Antonio | TX | 79 | Zara, H&M, Macy’s |

| Miami | FL | 79 | Zara, H&M, Nordstrom |

| Chicago | IL | 75 | Nordstrom, Bloomingdale’s, Macy’s |

These cities benefit from high foot traffic, tourism, and affluent consumer bases, making them ideal for mass-market and luxury retailers. New York City's dominance reflects its status as a global fashion hub, while cities like Las Vegas and Orlando capitalize on tourism-driven retail.

The scraped data reveals several insights:

Scraping store locations presents challenges, including navigating anti-scraping measures (e.g., CAPTCHAs), ensuring data accuracy, and managing large datasets. Ethical considerations involve respecting website policies, avoiding server overload, and ensuring data privacy. Retailers must also comply with regulations like the California Consumer Privacy Act (CCPA) when handling location data.

Scraping fashion retail locations in the USA provides valuable insights into the $564.2 billion apparel market, highlighting key players like TJX, Macy's, and Nike and identifying retailers with minimal footprints like Gucci and Shein. The geographical distribution underscores California, Texas, and Florida retail hubs, with cities like New York, Houston, and Las Vegas leading in-store counts, as detailed in the table. By leveraging web scraping, businesses can enhance strategic planning, optimize store placement, and adapt to evolving consumer trends. As e-commerce grows and sustainability gains traction, integrating scraped data with market analysis will be crucial for staying competitive in the dynamic U.S. fashion retail landscape. Ecommerce Data Scraping Services allow continuous tracking of fashion retailers' digital and physical footprints, while ecommerce Data Intelligence Services help correlate store performance with online behavior. Additionally, analyzing an Ecommerce Product Ratings and Review Dataset offers more profound insights into consumer sentiment and product trends.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.