In collaboration with a global research firm, an extensive analysis of nearly 2 million women's and men's clothing products listed on Amazon.co.uk was conducted. This comprehensive report highlights critical insights derived from the data aggregation. For a deeper dive into the findings, visit the research firm's website.

The analysis revealed that Amazon's fashion inventory is significantly influenced by inexpensive, generic brands predominantly sourced from overseas sellers, particularly in China. These generic brands dominate the Amazon Fashion listings. Additionally, the platform features many brands with limited product offerings. After excluding the top 10 most-listed obscure brands, the average brand on Amazon Fashion lists around 369 products. These insights underscore the effectiveness of Extracting Fashion & Apparel Data from Amazon UK, providing a valuable understanding of market trends and brand presence.

The most frequently listed well-known brands include Adidas, Under Armour, Nike, and Puma, underscoring the prominence of sportswear within Amazon's fashion segment. This data provides valuable UK Fashion Market Insights and demonstrates the effectiveness of Fashion Product Data. Web Scraping Amazon Apparel data helps in understanding market trends and brand presence.

Amazon's role in the UK apparel market has often been uncertain, with limited concrete data on its sales and market share. Nonetheless, Amazon's presence in the apparel sector is undeniable, and its growth is substantial—Amazon saw an estimated 22% increase in total UK sales in 2018. This report aims to shed light on the magnitude of Amazon's UK apparel offering.

In partnership with a global research firm, we aggregated data on nearly 2 million women's and men's clothing products listed on Amazon.co.uk. We analyzed this extensive dataset by leveraging Amazon Apparel Datasets, focusing on various aspects such as brand distribution, product categories, and seller types (first-party vs. third-party). Our findings offer valuable insights into Amazon's clothing inventory, illustrating the scale and diversity of its offerings.

Additionally, scrape Fashion Trends from Amazon UK to refine our understanding of market dynamics and consumer preferences. This comprehensive analysis, after scraping Amazon UK clothing listings techniques that were employed, highlights Amazon's significant impact on the UK apparel market and provides a detailed overview of its extensive product catalog.

Our analysis focuses on women's and men's clothing available on the Amazon UK Fashion site, utilizing comprehensive data aggregation methods. We employed Ecommerce Data Scraping Service to gather and analyze this data using a structured approach.

The data collection was executed in two key stages. Initially, we identified all brands featured in the top 513 product listings within each product subcategory for women's and men's clothing on Amazon.co.uk (e.g., top 513 listings for women's tops and tees, men's activewear, etc.). This approach ensured that we captured approximately 95% of the clothing sales on the platform, resulting in a dataset of 5,037 unique brands.

Following this, we conducted Fashion Item Data Scraping to aggregate detailed data on all product listings associated with these 5,037 brands. This second stage yielded 1.9 million individually listed products, which form the foundation of the analysis presented in this report.

Our methodology also incorporated Amazon UK Trend Monitoring techniques to track and evaluate market trends, providing a thorough understanding of the clothing landscape on Amazon UK. This detailed data analysis offers valuable insights into current fashion trends and market dynamics, essential for businesses seeking to leverage data-driven strategies in the apparel industry.

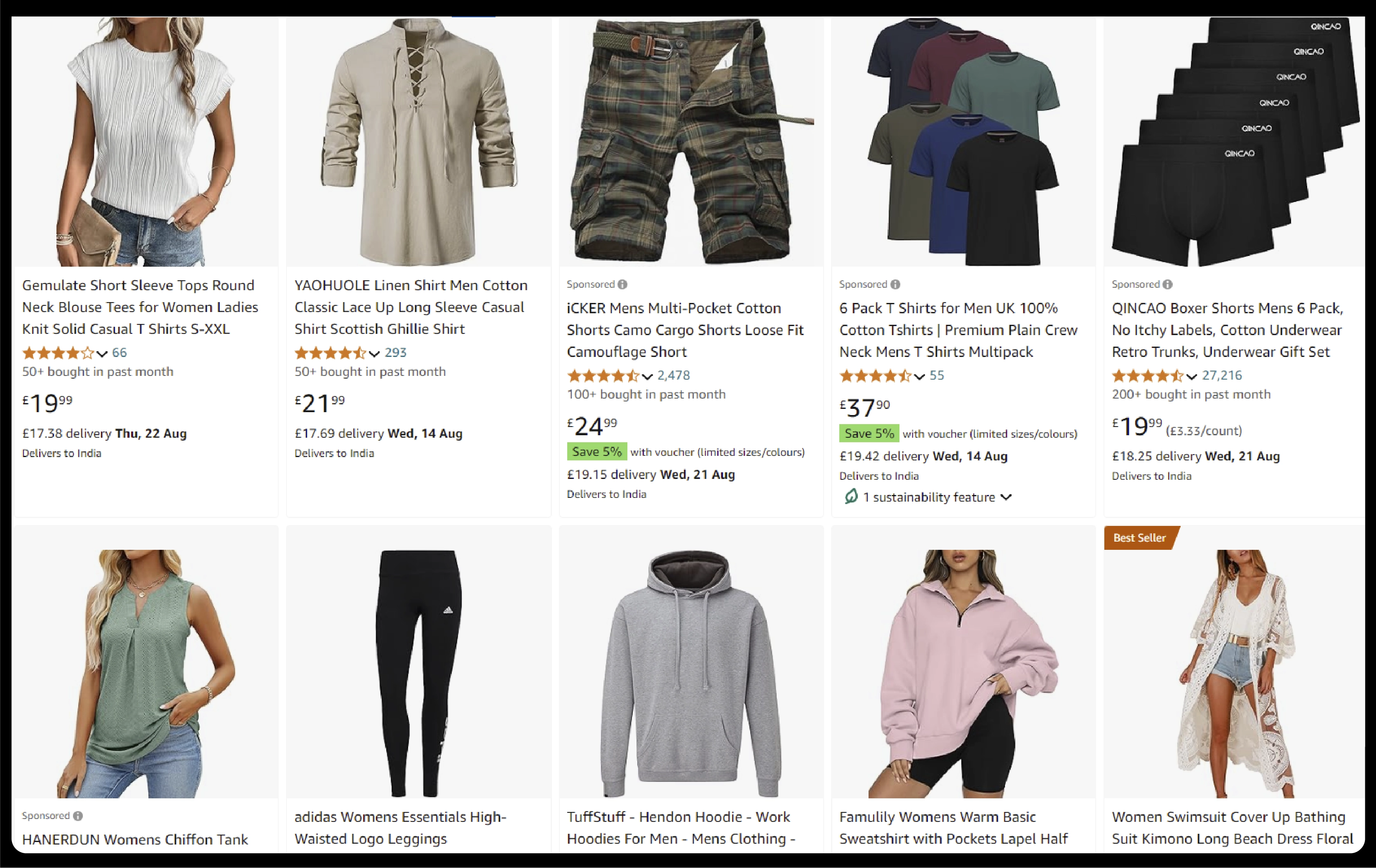

We identified 1.9 million women's and men's clothing products listed on Amazon.co.uk, though this figure does not encompass Amazon UK's apparel range. ASOS lists approximately 86,000 products for context, and Zalando offers over 408,000 products. In comparison, Amazon provides 1.2 million women's and 662,000 men's clothing items, with womenswear making up around two-thirds of the total listings.

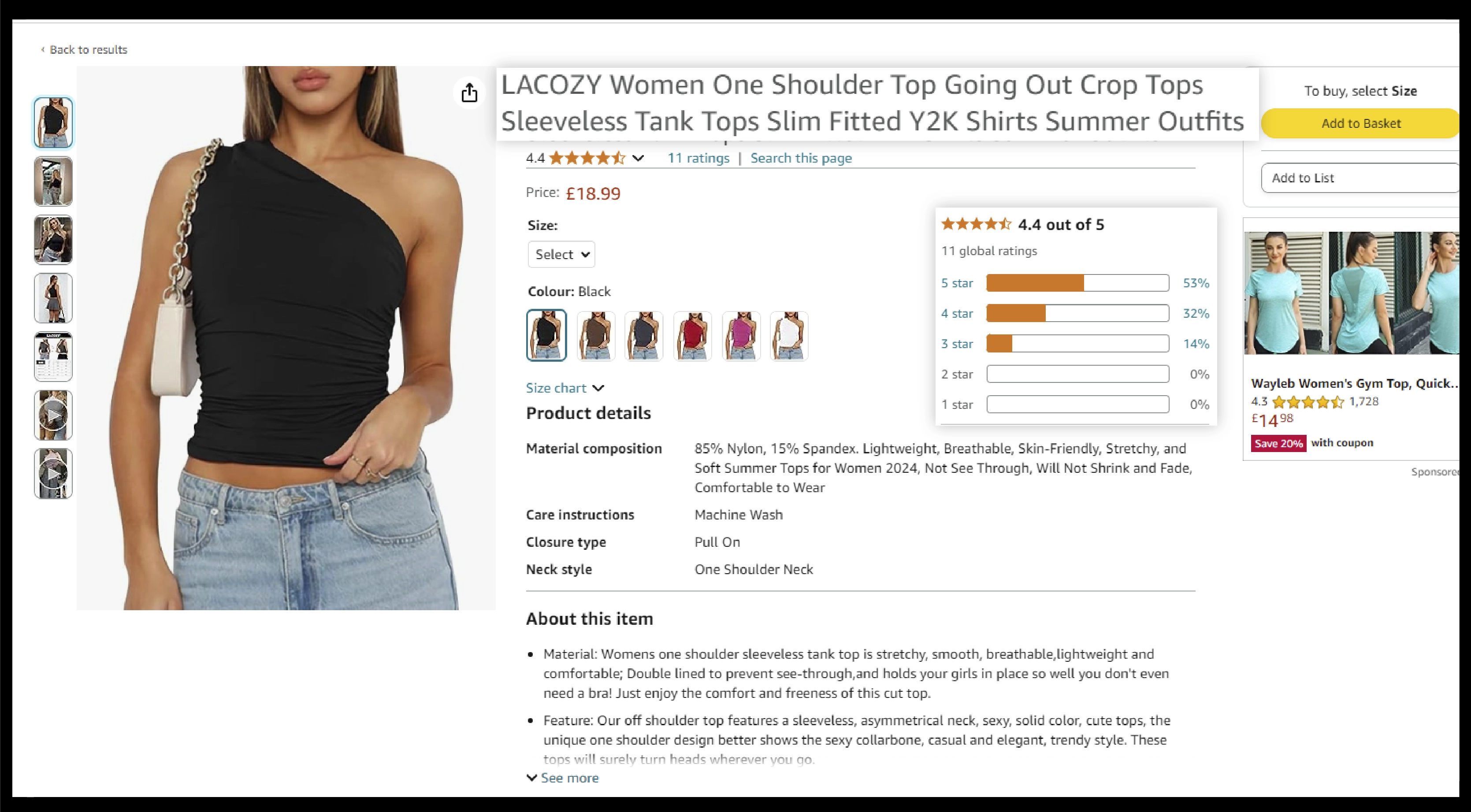

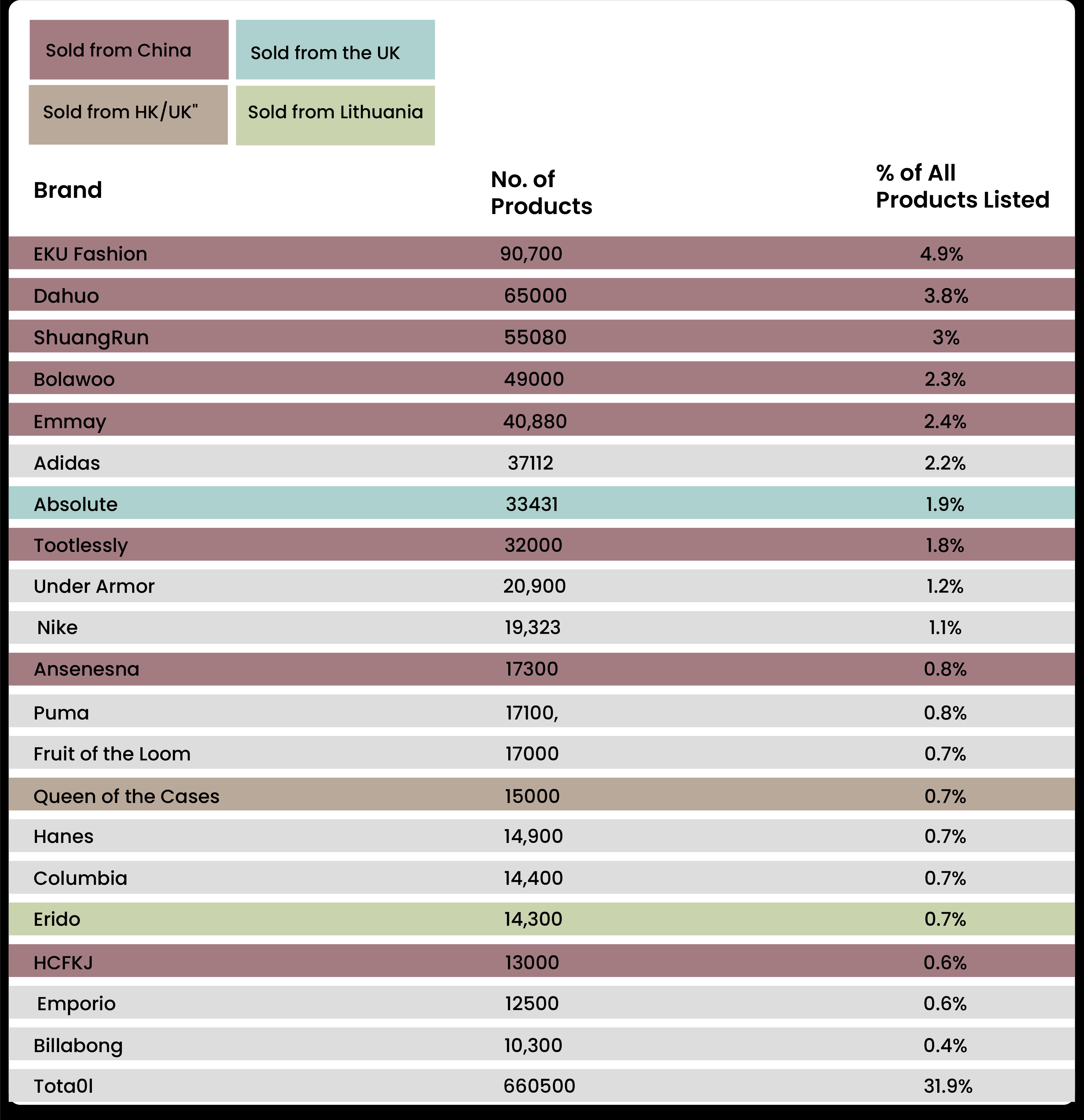

The vast scale of Extracting Amazon Product Data is supported mainly by inexpensive, generic-style brands sourced from overseas, primarily China. These lesser-known brands, such as EKU Fashion, Dahuo, and ShuangRun, dominate Amazon Fashion's listings. Notably, EKU Fashion lists nearly 89,000 clothing items, representing almost 5% of all clothing listings on Amazon UK.

Additionally, Amazon features many brands that list only a few products. Of the 5,037 brands analyzed, 2,481 have fewer than 100 items listed, and 714 brands offer only single-digit product counts. Once the 10 most-listed generic brands are removed from the dataset, the average brand on Amazon Fashion lists about 369 products.

These insights are drawn from our Amazon Product data scraper, incorporating Amazon Trend Analysis to provide a comprehensive view of the market dynamics and product distribution on Amazon.co.uk.

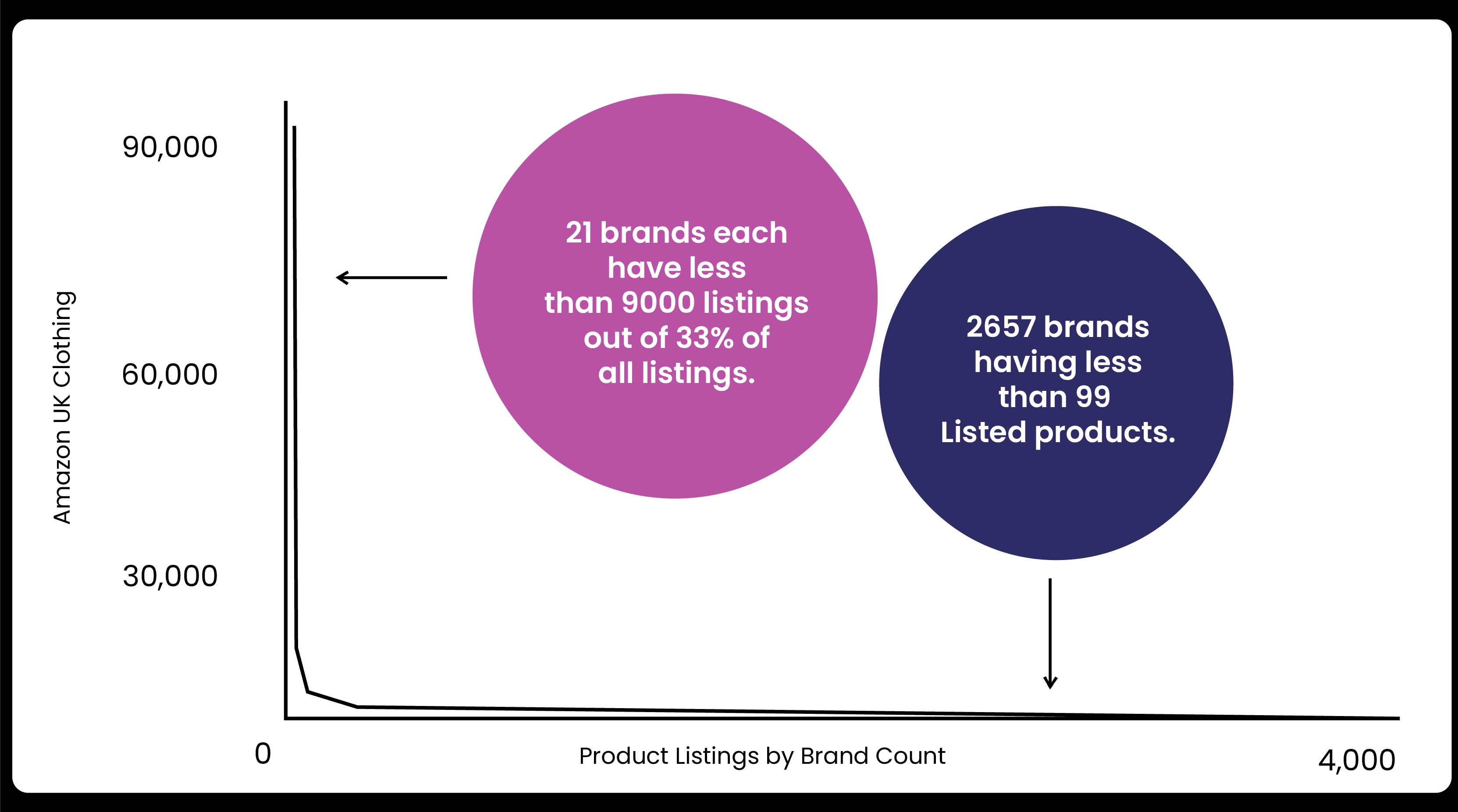

Scrape Fashion Websites Data to know how Amazon's extensive clothing inventory include nearly 2 million product listings, primarily shaped by two distinct categories: a few large brands with extensive product ranges and a vast array of smaller brands with minimal listings. This distribution is visually represented in the chart below.

A select group of eight brands each features over 30,000 product listings, while an additional 15 brands have 12,000 and 29,000 listings. These 21 brands, each with substantial listings, account for 31.2% of all clothing products on Amazon UK.

Conversely, 2,491 brands represent a significant portion of the total, and each list has fewer than 100 products. This "long tail" of brands includes many obscure, generic-style labels, often sourced from China, dominating the platform's listings. The overwhelming presence of these niche brands highlights the diverse and segmented nature of Amazon UK's fashion marketplace.

A blend of well-known names and lesser-known brands on Amazon UK Fashion shapes the marketplace. The top 20 most-listed brands collectively represent over 30% of all clothing products on the platform.

Interestingly, the leading positions in this ranking are occupied by obscure, budget-friendly brands primarily sourced from China. These lesser-known labels contribute significantly to the high volume of third-party listings on Amazon, as Amazon does not sell these brands directly. Many of these brands, such as ShuangRun, offer extremely low-priced items like men’s shirts for under £10 and women’s jackets for under £15. Some even list products like leather wallets for just a penny.

In contrast, renowned sportswear brands such as Adidas, Under Armour, Nike, and Puma are prominent among the most-listed brands. Notably, Adidas is the only major apparel brand with over 30,000 listings on Amazon UK. Other established brands, like Fruit of the Loom and Hanes, also rank high in product listings, reflecting their strong presence in the market.

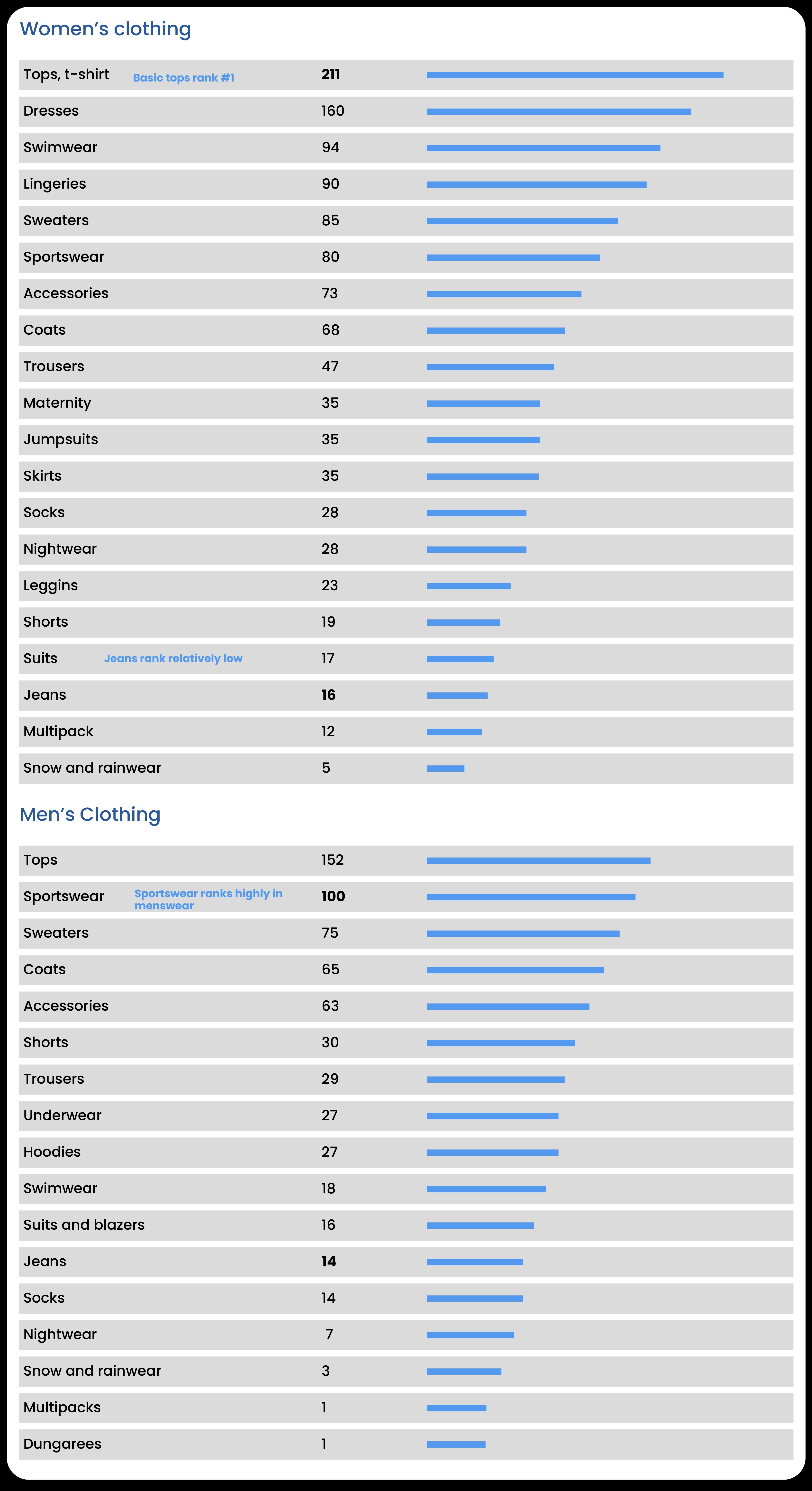

On Amazon UK, Chinese brands like EKU Fashion, Dahuo, and ShuangRun dominate various clothing categories, significantly impacting their rankings. These brands are prominent in categories such as dresses, coats, jackets, and sweaters, contributing to their high volume of listings. This extensive presence in these categories boosts their overall visibility on the platform.

However, these brands generally have a more limited selection in other categories, particularly jeans. Despite Amazon.co.uk offering nearly 18,000 women’s jeans and over 16,000 men’s jeans, the comparatively low number of listings from these brands in the jeans category affects its ranking within both womenswear and menswear. This disparity illustrates how the focus of these popular brands on certain types of apparel influences the representation of various clothing categories on the site.

Amazon UK's clothing marketplace is characterized by a diverse and extensive inventory, shaped significantly by inexpensive, generic brands from overseas, particularly in China. These obscure labels dominate listings, with notable examples including EKU Fashion and ShuangRun. While well-known brands like Adidas, Nike, and Puma maintain strong visibility, the dominance of generic brands highlights the vast "long tail" of lesser-known names contributing to the marketplace. This polarization is evident in product categories, with certain types like dresses and sweaters heavily represented. Ecommerce Data Scraper offers valuable insights into market trends, brand presence, and category dynamics, enhancing our understanding of this dynamic sector.

Discover unparalleled web scraping service or mobile app data scraping offered by iWeb Data Scraping. Our expert team specializes in diverse data sets, including retail store locations data scraping and more. Reach out to us today to explore how we can tailor our services to meet your project requirements, ensuring optimal efficiency and reliability for your data needs.