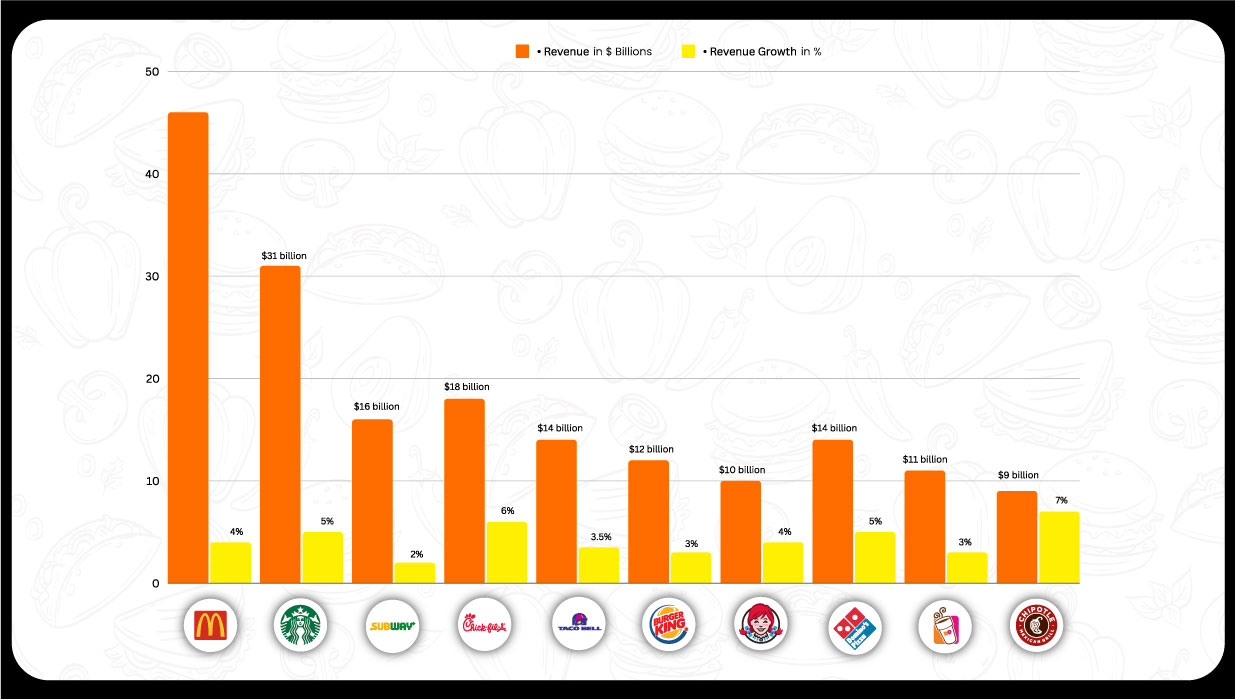

The food industry in the United States is led by a diverse array of chains catering to various tastes, demographics, and price ranges. In 2024, fast-food giants continue to dominate the market, with casual dining and coffee shop chains also holding a significant share. This report analyzes the Top 10 Largest U.S. Food Chains in 2024, focusing on growth and performance metrics. Significant players like McDonald's, Starbucks, and Subway lead the list. To remain competitive, businesses must Scrape Data from the Top 10 Largest U.S. Food Chains in 2024 to uncover trends in digital transformation and menu innovation. Collecting insights from these chains is crucial to understanding evolving market dynamics. Additionally, businesses should Extract Information from the Top 10 U.S. Food Chains to stay informed on strategies and consumer preferences, helping them adapt to shifts in the industry for long-term success.

McDonald's remains the largest and most iconic fast-food chain in the United States in 2024. With over 13,000 locations nationwide, it commands a substantial market share in the quick-service restaurant (QSR) industry. Known for its burgers, fries, and consistent global presence, McDonald's thrives on fast service, a recognizable brand, and continuous product innovation, such as healthier menu options and eco-friendly packaging. Businesses looking to understand McDonald's success can utilize U.S. Leading Food Chains Data Scraping for valuable insights.

Starbucks, the largest coffeehouse chain globally, continues its dominance in the U.S. coffee market with over 15,000 stores. Starbucks has focused heavily on its mobile app and digital ordering to boost customer convenience and loyalty. In 2024, the company expanded its menu to include more plant-based options and cold beverages, which have become significant revenue drivers. Companies can leverage Food Chains Data Scraping Services to track these trends effectively.

Once the largest chain in terms of locations, Subway still ranks high despite closing several underperforming stores. In 2024, Subway focused on menu innovation, including healthier, made-to- order sandwiches and partnerships with food delivery services to regain market share. Using Web Scraping Food Delivery Data, businesses can gather information on Subway's Partnerships and consumer preferences.

Chick-fil-A's strong focus on customer service, limited menu options centered around chicken, and reputation for high-quality food have allowed it to proliferate in recent years. It now has over 3,000 locations, with plans to expand further. Despite being closed on Sundays, Chick-fil-A outperforms many competitors in per-store revenue. Companies interested in analyzing its growth can consider Food Menu Data Extraction techniques.

Taco Bell, a subsidiary of Yum! Brands is known for its affordable and innovative Mexican-inspired menu. The chain continues to thrive on the success of its customizable offerings, limited-time menu promotions, and partnerships with delivery platforms like Uber Eats and DoorDash. In 2024, Taco Bell expanded its plant-based options in response to the growing demand for vegetarian and vegan fast food. Utilizing Restaurant Data Scraping Services can help businesses understand Taco Bell's promotional strategies.

Burger King, another iconic fast-food chain, has maintained its position as one of the largest burger chains in the U.S. In 2024, Burger King strongly emphasized revamping its menu with healthier options, including plant-based burgers. The company has also invested heavily in upgrading its digital platforms and drive-thru technology to enhance customer experience. Businesses can analyze these digital innovations using Food Delivery App Data Scraping APIs.

Wendy's is known for its fresh, never-frozen beef, which differentiates it from many competitors. Wendy's has continued to grow in 2024 by focusing on digital ordering, expanding its breakfast menu, and capitalizing on consumer demand for higher-quality fast food. The chain is also rolling out more "Wendy's Next-Gen" stores, focusing on sustainability and tech-enhanced service. For insights into WWendy's evolving strategy, companies can use U.S. Leading Food Chains Data Scraping to gather valuable information.

Domino's, the largest pizza chain in the U.S. by revenue, has been a leader in the digital transformation of the food industry. In 2024, Domino's will continue to invest in online ordering platforms, delivery services, and automated cooking technologies to stay ahead of the competition. The brand is known for its fast delivery and customer-friendly mobile app. For businesses analyzing growth, Food Chains' Location Data Collection can provide insights into their extensive network and market reach.

Dunkin' Donuts rebranded as "Dunkin'," is a significant player in the coffee and breakfast categories. With over 9,500 locations in the U.S., the chain has maintained strong sales due to its diverse menu offerings, from coffee drinks to breakfast sandwiches. Dunkin' has also benefited from its growing digital loyalty program and mobile app, making it easier for customers to order and earn rewards. Companies can leverage a Food Delivery App Data Scraper to track Dunkin's menu innovations and customer engagement strategies.

Chipotle focus on fresh, ethically sourced ingredients and customizable Mexican cuisine has made it one of the fastest-growing fast-casual chains in the U.S. In 2024, Chipotle continues to lead in the health-conscious dining space, focusing strongly on sustainability and digital ordering through its app. The chain has expanded into new markets and significantly increased its digital sales. Businesses can benefit from analyzing food delivery app datasets to gain insights into Chipotle's sales strategies and consumer preferences.

The table below compares the revenues of the top 10 food chains over the past three years, showcasing their financial growth and market positioning.

| Rank | Company | 2022 Revenue ($B) | 2023 Revenue ($B) | 2024 Revenue ($B) | Growth (2022-2024) | Locations (2024) |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 44 | 46 | 47.84 | 8.7% | 13,000 |

| 2 | Starbucks | 28.5 | 31 | 32.55 | 14.2% | 15,000 |

| 3 | Subway | 15.7 | 16 | 16.32 | 4% | 20,000 |

| 4 | Chick-fil-A | 16.5 | 18 | 19.08 | 15.6% | 3,000 |

| 5 | Taco Bell | 13.5 | 14 | 14.49 | 7.3% | 7,900 |

| 6 | Burger King | 11.8 | 12 | 12.36 | 4.7% | 7,200 |

| 7 | Wendy’s | 9.6 | 10 | 10.4 | 8.3% | 6,500 |

| 8 | Domino’s | 13.2 | 14 | 14.7 | 11.4% | 6,700 |

| 9 | Dunkin’ | 10.8 | 11 | 11.33 | 4.9% | 9,500 |

| 10 | Chipotle Mexican Grill | 8.1 | 9 | 9.63 | 18.9% | 3,500 |

1. Revenue Growth Trends:

2. Digital and Delivery Services:

3. Menu Innovations:

4. Market Saturation and Expansion:

The U.S. food industry 2024 is led by well-established brands, with McDonald’s, Starbucks, and Subway continuing to dominate the landscape. However, growth leaders like Chick-fil-A, Chipotle, and Domino’s rapidly expand their market share by adapting to consumer demands for healthier, more convenient, digitally integrated dining experiences. This year-wise comparison underscores the importance of innovation, customer service, and digital transformation in maintaining and growing market positions. The ability to adapt to changing consumer preferences and leverage new technologies will be critical for the sustained success of these chains in the coming years.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.