As of 2025, the U.S. grocery market continues to evolve, with total supermarket sales reaching approximately $846 billion in 2023, representing 85% of the nation's food and beverage retail sector. Kroger Grocery Delivery Data Scraping Services are becoming essential for tracking and analyzing the rapidly growing market. Projections indicate that the market will grow at a CAGR of 3.5% from 2025 to 2030, surpassing $1 trillion by the end of the decade.

Kroger competitor analysis data shows that Kroger maintains a significant position, holding a 13% market share, second only to Walmart's 22%. Extract Kroger Supermarket Data to gain insights into their pricing strategies, product assortment, and delivery services. Other major players, such as Costco (8%) and Albertsons (5%), continue to compete aggressively, further emphasizing the need for data-driven strategies in this competitive landscape.

In this context, utilizing this service provides businesses with the tools to stay ahead by closely monitoring competitor activities and consumer preferences. This report examines Kroger's standing relative to key competitors, focusing on store distribution data scraping, retail proximity analysis scraping, and geographic competition analysis across states and cities. Advanced data scraping methodologies provide insights into store density, emerging retail hotspots, and competitive encroachment, helping businesses strategize in an increasingly dynamic grocery landscape.

Retail location data scraping reveals that Kroger operates in 16 states, whereas Walmart spans 52 states and Target 51. This selective footprint impacts its competitive positioning, making supermarket location intelligence crucial for market expansion strategies.

Grocery Data Scraping Services can provide valuable insights into Kroger’s presence in each state, helping to identify growth opportunities and optimize resource allocation. By analyzing Kroger Grocery Datasets, businesses can also understand regional preferences and demand patterns. Moreover, this data can be used to refine marketing campaigns, supply chain strategies, and product offerings based on specific regional needs.

As competition intensifies, leveraging location-based data will be essential for maintaining a competitive edge in the grocery retail industry.

| Rank | State | Total Stores |

|---|---|---|

| 1 | Texas | 945 |

| 2 | California | 812 |

| 3 | Florida | 525 |

| 4 | Ohio | 428 |

| 5 | Georgia | 424 |

| State | 2025 Stores | 2030 Projected Stores | Growth Rate (%) |

|---|---|---|---|

| Texas | 945 | 1,120 | 18.3% |

| California | 812 | 980 | 20.2% |

| Florida | 525 | 645 | 21.9% |

| Ohio | 428 | 495 | 14.9% |

| Georgia | 424 | 510 | 18.9% |

With grocery store data extraction, businesses can analyze Kroger’s distribution versus competitors and identify expansion opportunities. Kroger competitor analysis data highlights how store proximity affects consumer choices and pricing strategies. Additionally, supermarket location intelligence helps retailers optimize site selection, improve logistics, and anticipate future market shifts.

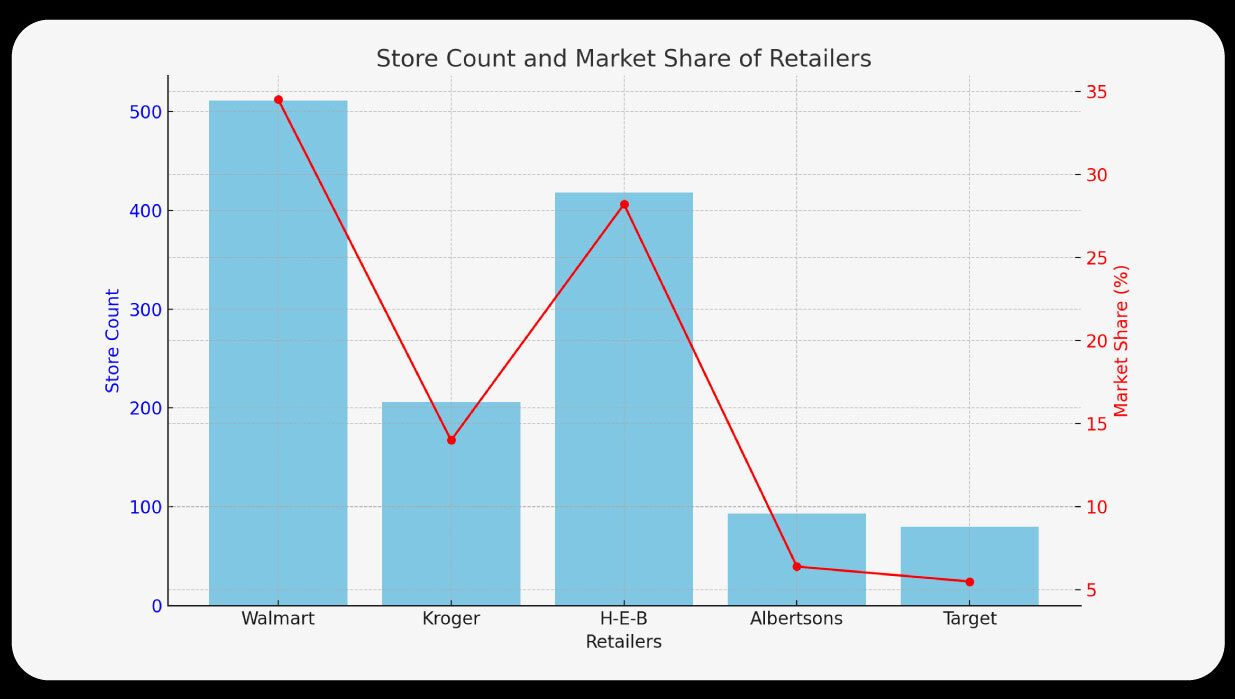

Texas is a major battleground for grocery retailers. Grocery store data extraction reveals that Kroger operates 206 stores in Texas, making it the second-largest grocer after Walmart, which has 511 locations. Other key competitors include H-E-B (418 stores), Albertsons (93 stores), and Target (80 stores). Supermarket location intelligence suggests that Kroger’s strategic focus on Texas is crucial for its overall market positioning.

| Rank | Retailer | Store Count | Market Share (%) |

|---|---|---|---|

| 1 | Walmart | 511 | 34.5% |

| 2 | Kroger | 206 | 14.0% |

| 3 | H-E-B | 418 | 28.2% |

| 4 | Albertsons | 93 | 6.4% |

| 5 | Target | 80 | 5.5% |

| Retailer | 2025 Stores | 2030 Projected Stores | Growth Rate (%) |

|---|---|---|---|

| Walmart | 511 | 580 | 12.8% |

| Kroger | 206 | 245 | 17.8% |

| H-E-B | 418 | 500 | 19.0% |

| Albertsons | 93 | 110 | 15.8% |

| Target | 80 | 95 | 15.9% |

With store distribution data scraping, businesses can assess Kroger’s performance relative to competitors, identifying opportunities for expansion. Retail proximity analysis scraping provides insights into competitive store density, while grocery market research data helps retailers refine pricing and product strategies. Competitor store location data further enables businesses to track new openings and market saturation trends, helping Kroger strengthen its position in the Texas grocery market.

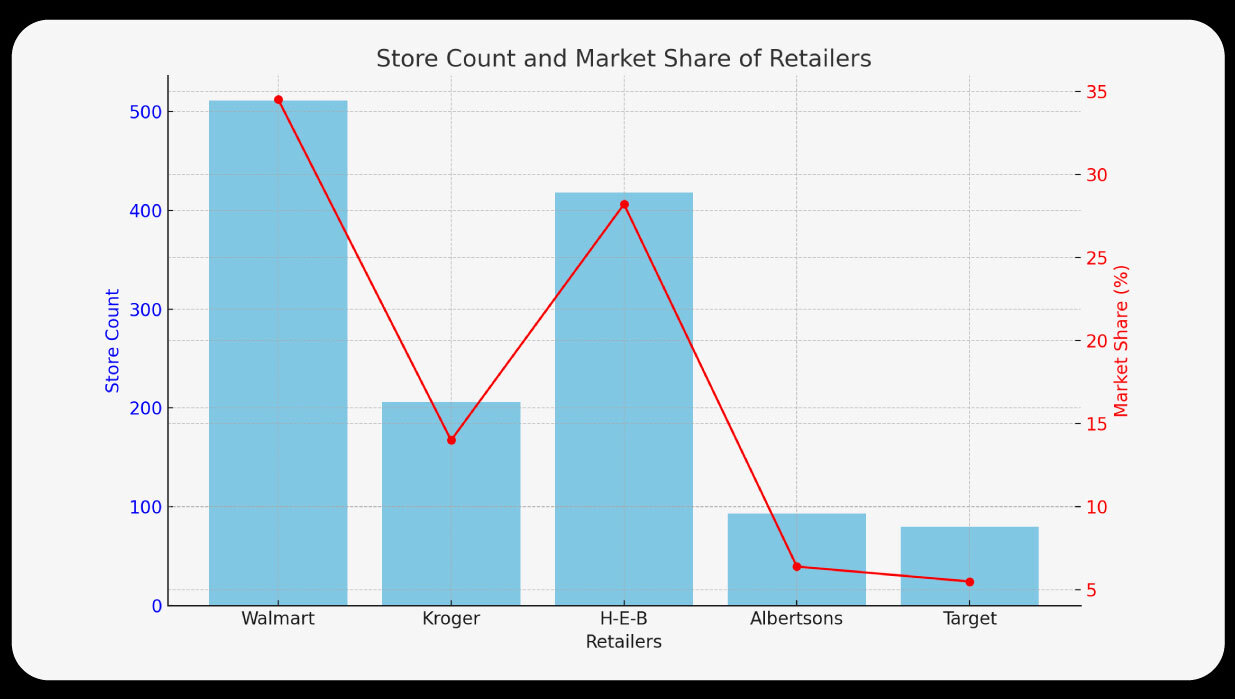

On a city level, retailer presence mapping data and retail location data scraping highlight Kroger's strong footprint in major metropolitan areas. Grocery store data extraction shows that in Houston, H-E-B dominates with a 24.9% market share, while Kroger follows closely with 22%, reflecting fierce competition. Other key cities where Kroger maintains a competitive presence include Dallas, Atlanta, Cincinnati, and Denver.

| City | Kroger Stores | Market Share (%) | Leading Competitor | Competitor's Share (%) |

|---|---|---|---|---|

| Houston | 110 | 22.0% | H-E-B | 24.9% |

| Dallas | 85 | 18.5% | Walmart | 30.2% |

| Atlanta | 72 | 21.7% | Publix | 28.0% |

| Cincinnati | 98 | 35.4% | Walmart | 22.1% |

| Denver | 65 | 19.8% | Safeway | 25.3% |

| City | 2025 Kroger Stores | 2030 Projected Stores | Growth Rate (%) |

|---|---|---|---|

| Houston | 110 | 125 | 13.6% |

| Dallas | 85 | 98 | 15.3% |

| Atlanta | 72 | 84 | 16.7% |

| Cincinnati | 98 | 108 | 10.2% |

| Denver | 65 | 77 | 18.5% |

With Kroger competitor analysis data, retailers can evaluate city-level market trends, competitor expansions, and store distribution strategies. Supermarket location intelligence enables retailers to optimize site selection, forecast demand, and refine pricing strategies based on geographic competition insights. As Kroger expands in key metropolitan areas, leveraging retail location data scraping and grocery store data extraction will be critical for maintaining its market position against dominant competitors.

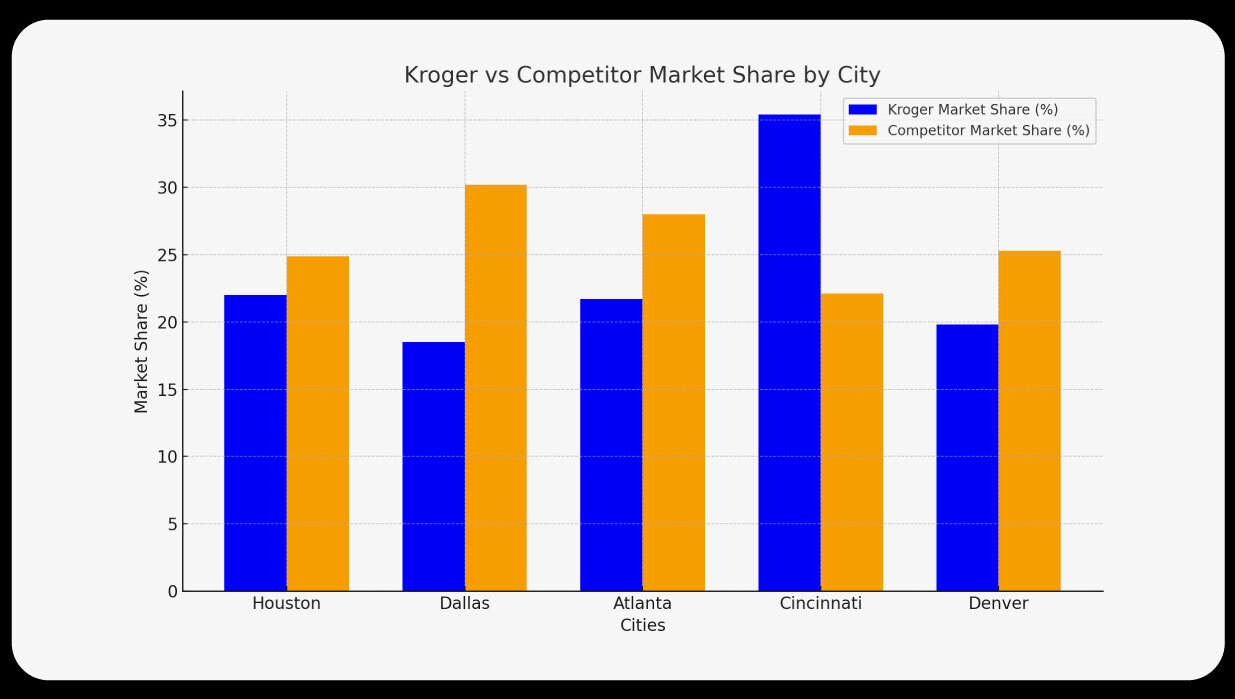

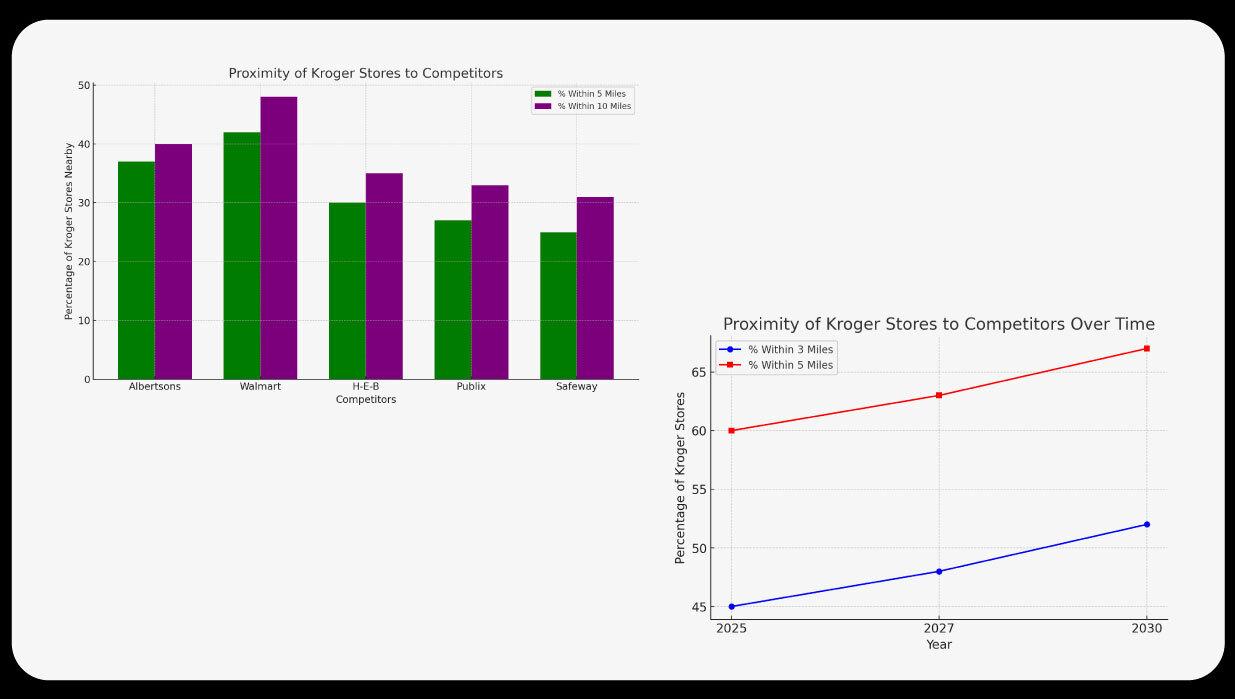

Retail proximity analysis scraping reveals that 37% of grocery stores within a 5-mile radius of an Albertsons are Kroger-branded, increasing to 40% within a 10-mile radius. This highlights a strong competitive overlap. Competitor store location data shows that Kroger also faces intense competition from Walmart, H-E-B, and Publix in key regions. Geographic competition analysis further indicates that nearly 45% of Kroger stores nationwide have at least one major competitor within 3 miles, intensifying market pressures.

| Competitor | % of Kroger Stores Within 5 Miles | % of Kroger Stores Within 10 Miles |

|---|---|---|

| Albertsons | 37% | 40% |

| Walmart | 42% | 48% |

| H-E-B | 30% | 35% |

| Publix | 27% | 33% |

| Safeway | 25% | 31% |

| Year | % of Kroger Stores with Competitor Within 3 Miles | % of Kroger Stores with Competitor Within 5 Miles |

|---|---|---|

| 2025 | 45% | 60% |

| 2027 | 48% | 63% |

| 2030 | 52% | 67% |

With store distribution data scraping, businesses can assess store density and optimize expansion strategies. Grocery market research data helps in understanding regional market saturation and identifying high-potential areas. Retailer presence mapping data and geographic competition analysis provide deeper insights into competitor store locations, enabling Kroger to refine site selection and maintain a strategic advantage in the grocery market.

Grocery market research data confirms that Kroger’s strategy revolves around concentrated market penetration in select states and cities rather than nationwide expansion. By focusing on key regions, Kroger strengthens its competitive positioning against Walmart, H-E-B, and Albertsons. To gain deeper insights into this strategy, businesses can utilize a Kroger Grocery Delivery Data Scraper to track and analyze regional trends and customer behaviors. This tool helps identify potential gaps in the market and areas where Kroger is outperforming its competitors, allowing for more informed decision-making in marketing and expansion efforts.

Geographic competition analysis highlights Kroger’s need to adapt pricing, product offerings, and customer service to maintain and expand its market share. Retail proximity analysis scraping reveals significant competitor overlap, requiring Kroger to refine its market strategies.

Retail location data scraping and grocery store data extraction indicate that Kroger prioritizes expansion in high-demand urban and suburban areas. Unlike Walmart and Target, which have a national footprint, Kroger's selective approach enhances brand loyalty and operational efficiency.

Supermarket location intelligence suggests that Kroger’s expansion efforts will target metropolitan areas and high-growth suburban regions where competition is strongest. Strategic site selection will be essential for sustaining growth and market share.

Kroger competitor analysis data highlights increasing competition from Walmart, Costco, and regional chains. Retail proximity analysis scraping suggests that Kroger must continuously innovate through personalized promotions, competitive pricing, and enhanced in-store experiences to counter competitive pressures.

Competitor store location data emphasizes the importance of tracking new store openings, market saturation, and evolving consumer preferences. Kroger’s ability to leverage data-driven insights will be crucial for maintaining its stronghold in key regions.

By utilizing supermarket location intelligence and grocery market research data, Kroger can refine its expansion strategy, optimize store locations, and strengthen its competitive position in the evolving grocery retail landscape.

Understanding competitive landscapes is crucial for businesses. We specialize in grocery store data extraction, retail location data scraping, and store distribution data scraping to help businesses make informed decisions.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.