Data has become the key driver of innovation, market competitiveness, and strategic growth in today's fast-evolving automotive landscape. With more consumers turning to online platforms for vehicle research and purchases, the ability to Extract Vehicle Listing Data for Automotive Marketplaces is transforming how businesses understand the market. By leveraging this powerful approach, companies can gain real-time insights into vehicle specifications, dynamic pricing trends, regional demand patterns, and consumer preferences. Whether analyzing used car availability, monitoring competitive pricing, or identifying top-selling models by location, this data fuels smarter decision-making across sales, marketing, and inventory planning. Tools like a Vehicle Inventory Web Scraping API also streamline the collection of structured vehicle data from major automotive marketplaces. This allows stakeholders—from dealerships and OEMs to fintech and insurance firms—to access accurate, up-to-date data at scale, empowering them to stay responsive in a digitally driven market and maintain a strategic edge over competitors.

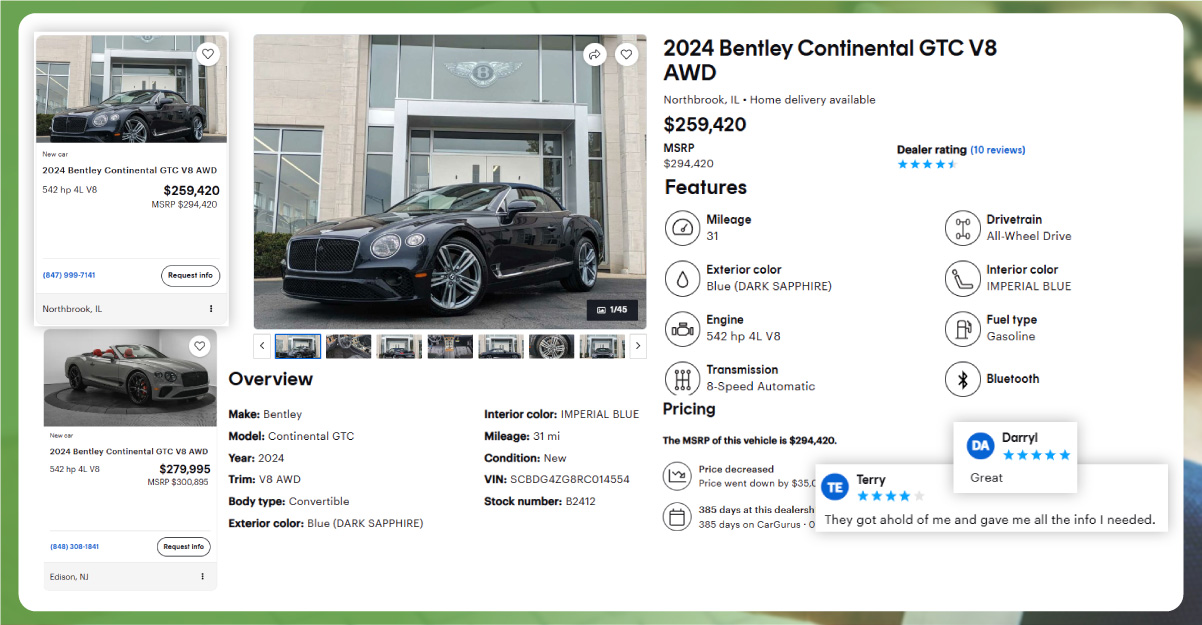

Automotive marketplaces, such as CarGurus, Autotrader, Cars.com, Edmunds, and TrueCar, serve as comprehensive platforms where dealers and private sellers list thousands of vehicles. These platforms contain rich data that reflect current inventory, market sentiment, pricing strategies, and evolving customer expectations. When businesses Scrape Vehicle Listing Data for Automotive Marketplaces, they gain a competitive advantage through timely insights that are otherwise buried in massive, unstructured online content.

This extracted data enables various stakeholders to make data-backed decisions—whether a dealer adjusts prices to match competitors, a manufacturer tracks brand visibility, or a fintech company builds auto loan risk models based on vehicle depreciation patterns. Businesses can understand buyer demand and inventory trends through Vehicle Pricing and Features Data Extraction. At the same time, tools like a Vehicle Pricing Data Scraping API automate access to granular, structured pricing information. This empowers more innovative strategies across sales, financing, and fleet management in the digital automotive ecosystem.

When discussing vehicle listing data extraction, we refer to structured, formatted details collected from listing pages. This includes:

With such a detailed pool of attributes, businesses can slice and dice the data to generate actionable insights.

Auto manufacturers, dealerships, marketers, and data-driven startups all harness vehicle listing data to optimize their strategies. Here's how:

Unlock real-time vehicle market insights today with our powerful vehicle data scraping solutions—start your journey now!

As listing data becomes a critical component of business intelligence, automotive data aggregators are stepping in to simplify access. These services consolidate vehicle listings from multiple sources into a unified format, enabling businesses to run comparative analyses, train AI models, or populate their marketplaces with fresh inventory. Furthermore, aggregators enrich raw vehicle data with VIN decoding, real-time valuation tools, and market trend dashboards. This elevates the value of scraped data from a static dataset to a dynamic intelligence engine.

Understanding vehicle value is crucial for fintech startups offering auto loans or vehicle subscription services. Listing data provides the base for building depreciation models, tracking how optional features influence resale value, and estimating risk based on historical price fluctuations.

Similarly, insurers can use extracted data to estimate claim risks, create tailored premiums based on vehicle conditions and features, and detect potential fraud (e.g., falsely advertised mileage or accident-free claims).

AI applications in the automotive sector are rising—from vehicle pricing prediction to fraud detection and visual feature recognition. These systems need vast and varied datasets to train accurately. Extracting vehicle listing data ensures access to clean, labeled, and up-to-date data that machine learning models thrive on. For example, AI models trained on listing images and corresponding metadata can automate vehicle recognition, classify interior quality, or suggest ideal resale prices

Many dealers list identical vehicles across multiple platforms. By extracting and comparing listings from different marketplaces, companies can detect cross-posting patterns, assess syndication performance, and ensure consistency in pricing and branding. This also helps identify duplicate listings, vehicle details inconsistencies, and third-party syndication network gaps.

Online automotive marketplaces rely heavily on recommendation engines. Extracted vehicle data feeds these engines to improve personalization—suggesting relevant listings based on past browsing, preferred features, or price range. Moreover, this data can be used to build user-centric filters, predictive alerts (e.g., "This car is likely to sell soon"), and virtual garage tools that allow customers to track vehicles over time.

With multi-country vehicle data extraction, businesses gain a global view of automotive trends. This is especially relevant for international brands evaluating expansion strategies or monitoring their global product lines' performance across continents. For example, certain trims or models may be more popular in Europe than North America, influencing product lifecycle decisions.

Automotive design and product development teams can use extracted data to spot gaps in the market. If listings show a growing interest in compact electric SUVs with specific feature sets, that information can inspire new model designs or influence upcoming vehicle lineups.

The ability to Extract Vehicle Listing Data for Automotive Marketplaces has transformed from a niche data tactic into a mainstream strategy for decision-making across the automotive ecosystem. It empowers dealers, OEMs, marketers, analysts, insurers, and fintech players to operate smarter, faster, and more in tune with the ever-changing demands of today's digital-first automotive consumer.

By tapping into real-time listing data, stakeholders unlock the insights they need to stay ahead of the curve—launching the next best-selling vehicle, setting optimal prices, or designing personalized shopping experiences. In this data-driven era, those who embrace vehicle listing data extraction are positioned to lead the future of mobility

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.